This Is Why You Should Create a Balance Sheet for Your Business Immediately

In almost everything we do, balance has got to be the key. Without balance, life can be a chaos since everything is out of order. Same goes when it comes to your personal finances. If you want to improve your finances, you have got to start on how you will be able to handle it as well as how you can manage it and one way to do it is by balancing everything. Most people think that budgeting their money alone is good enough, but there is actually one more thing that may be more effective for you, and that is by creating your own balance sheet.

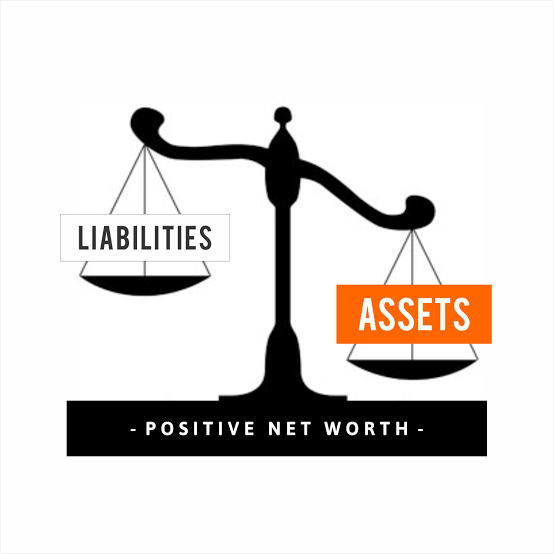

Assets must always be more than liabilities

The Balance Sheet

Some people think that creating a balance sheet for their personal finances may take too much of their time, but what they don’t know is that it may actually be worth it for them. A balance sheet is basically a list of all your assets together with all of your liabilities and even your net worth.

Your personal assets are those things that you own that most likely has a value to it since it is something that you can sell. A liability, on the other hand, is something that you own but hasn’t paid for yet, so it’s basically debts that you must pay for such as a mortgage or your credit cards, while the net worth will be the sum of all of your sold assets as well as the remaining money that you have once have paid all of your liabilities.

The balance sheet is literally the easiest way possible to figure out how much your net worth actually is. It has been widely used by people in the business industry for their own companies, but they have the shareholder’s equity invoked in it which is the same as a person’s net worth. Countries also have their own balance sheet but they don’t exactly publish it completely.

This just means that balance sheets can literally be used to anything that has an economic function, so if you get a hang of it by trying it out, then you can make one of your family. The balance sheet is there for you to have a hands-on approach on how things are going with your financial status.

For instance, you used your credit card to buy your basic needs, you also have a mortgage and a car loan, but your daily expenses are coming from your pocket in cash. All of these things are economic actions that will let you know where you are and how you must handle things.

They all have double consequences and so you have to balance it all out, which means you cannot afford to pay for everything in cash, hence their liabilities, but you, of course, cannot have loans and credit cards for everything without having the cash to pay for it all eventually. It is called balance sheets for a reason.

Eliminate Mistakes

Despite having a balance sheet, there are still some people who are either not committed to it or just doesn’t care about the balance at all, and they usually end up going bankrupt because of how much debt they have. One of the most common things that led to this mistake is by abusing the power of your credit cards, an average American has at least two or more credit cards in their wallets and unfortunately a huge percentage of them are way too deep into debt that they fail to pay for their bills, and in some worst cases they try to pay for these bills with other credit cards or loans.

This alone makes it impossible for them to keep the balance since they keep on borrowing money that they eventually have to pay for. People who are obsessed with using their credit cards will most likely never get their way out of their own financial hole that they got themselves into unless of course, they choose to change their ways and pay for their debts to start over.

Another common mistake would be not having any sort of savings. Some people think that they are saving money, but they are not exactly letting it stay there since they’re constantly dipping into it every once in a while. This may not be involved in the balance sheet but you can always make an addition by figuring out how much you have saved in a week or a month and how it affects how much you spend.

More in Advisor

-

`

Intel Invests in Nvidia, but Ratings Remain Unchanged

Intel’s stock jumped more than 30% after news broke that Nvidia poured $5 billion into the company. The rally sparked renewed...

October 5, 2025 -

`

Homeownership vs. Real Estate Investment: What’s Better?

Homeownership has long been seen as the American dream. But today, more people are asking: Is it really the smartest way...

October 3, 2025 -

`

Why the Armani Fashion Empire Is Set for an IPO

Giorgio Armani, one of the most iconic names in global fashion, left behind a detailed plan for the future of his...

September 27, 2025 -

`

Why Do Pokémon Cards Outperform the S&P 500 As an Investment?

Pokémon cards have outperformed the stock market by a mile. Since 2004, they have delivered a staggering 3,821% return, according to...

September 27, 2025 -

`

America’s Billionaires Get Older—Millennials Wait for Wealth Transfer

Many of today’s billionaires don’t match the youthful tech-founder image often portrayed. While names like Elon Musk, Sam Altman, and Mark...

September 21, 2025 -

`

Can President Trump Legally Fire Fed Governor Lisa Cook?

Lisa Cook is right in the middle of one of the most explosive legal battles in Washington. President Trump wants her...

September 20, 2025 -

`

Jeff Bezos’ Advice for Millennials Who Want Financial Success

Millennials today have grown up in a world where instant access to products and services is the norm. From two-day deliveries...

September 13, 2025 -

`

Maison Margiela’s First-Ever Celebrity Campaign Stars Miley Cyrus

Miley Cyrus just changed the rules again. In August 2025, she became the first celebrity ambassador in Maison Margiela’s 37-year history....

September 12, 2025 -

`

Should You Rely on AI for Financial Advice? Here’s What Financial Experts Say

AI is everywhere right now, and yes, that includes your wallet. From budgeting to retirement planning, tools like ChatGPT, Google Gemini,...

September 6, 2025

You must be logged in to post a comment Login