Philippine SEC To Regulate Crowd-Funding For Small Businesses

The Philippine Security and Exchange Commission will regulate the crowd-funding activities in the country. This is to ensure that the investing public is protected from the abuse of innovative fund-raising that usually designed for start-up companies.

What is Crowd-funding?

Philippine SEC to Regulate Crowdfunding for Small Business Enterprises

Crowd-funding is a fund-raising method where money is sourced from a large number of individuals, typically through an online platform. The said method allows the investor an access to different opportunity in investments. This also allows not only start-up businesses but also the small and medium-sized enterprises (SMEs) to be able to access a new way of funding for their operations and investment by using the internet.

It may also be defined as funding a venture or a project by raising multiple small amounts of cash coming from a lot of people via the internet. It is an alternative finance in the form of crowdsourcing. There are a lot of similar concepts made via benefit events, subscriptions and other methods the term “crowdfunding” also refers to the registries which are mediated on the internet. The focus solicitation of funds using different ways is one way to define it. Crowdfunding has been used to fund large-scale entrepreneurial ventures like community-oriented entrepreneurship projects, travel, medical expenses and even the creative and artistic projects.

The Security and Exchange Commission said they would release the draft of rules and regulations that govern crowd-funding for the feedback of the public in a press statement.

The SEC is set to Draft Rules and Regulations for Crowdfunding

The proposed rules of SEC will regulate both the lending and equity-based crowd-funding. The SEC will require the registration and full disclosure of issuer, the intermediary such as people that registered and funding portal, and platform. This will also make prescriptions on the disclosure of the issuer’s requirements for intermediaries and the registration of the funding portals.

The set of rules will also serve as the threshold of the amount of funding that is to be raised using crowd-funding. The cap proposed within a 12-month period is at P10 million. Advertising the terms of the offering is being proposed by SEC to be prohibited. The framework includes measures of reducing the risks of manipulation and fraud as well as including the provisions on the conditional safe harbor where there are certain limited activities are deemed to be consistent with the funding portal’s prohibitions.

The qualified investors are also planned to be restricted by the SEC in terms of crowd-funding activities. The qualification of the investor will be defined by the framework.

The rules are set to require the parties in providing instructions about the provision of the instructions regarding the completion of offerings, cancellations as well as the reconfirmations. The provision of the instructions pertaining to the maintenance and transmission funds and the educational materials.

The SEC Will also Limit Crowdfunding Activities for those Qualified Investors

The model of the crowd-funding normally involves three parties. These parties are the platform, supporters, and the entrepreneur. The platform is an organization that moderates and acts as the virtual marketplace that brings the different parties together to launch the project. The supporters are defined to be the individuals or the groups of individuals who are willing to support the idea or fund the project. The entrepreneur is the initiator of the project that provides the business or project proposal. It is through the o line platforms in which the supporters of the project or idea make their donations or contributions. The platforms will do the coordination and administration of the fund-raising activities after.

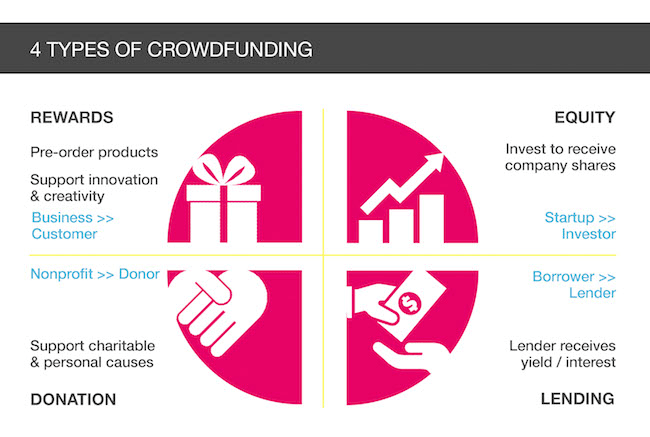

In general, there are four forms of crowd-funding: the equity-based, lending-based, reward-based, and the donation-based.

Four Types of Crowdfunding

The donation-based crowdfunding is where the individuals gather their resources for the purpose of supporting a charitable cause. The reward-based crowdfunding is where the individuals give money to a company as an exchange for a reward. This is usually a product that is produced by the company. The lending-based crowdfunding is where the individuals lend money to the company. In return, the individuals will receive the legally-binding commitment of the company to repay the loan at a predetermined rate of interest and time intervals. The equity-based crowdfunding is where the individuals invest in the shares that are being sold by the company. These individuals receive a share of the profits by profit distribution and dividends subjected to the discretion of the company.

More in Investments

-

`

Will Bitcoin Crash to $0 or Hit $500K in a Decade?

Bitcoin’s future divides analysts into two extreme camps. Some see it becoming one of the most valuable financial assets in history....

October 12, 2025 -

`

Can Anyone Really Blame Mariah Carey for ‘Leaving’ the Real World?

Mariah Carey isn’t like the rest of us. From the moment she opens her mouth and that voice pours out, she...

October 10, 2025 -

`

Intel Invests in Nvidia, but Ratings Remain Unchanged

Intel’s stock jumped more than 30% after news broke that Nvidia poured $5 billion into the company. The rally sparked renewed...

October 5, 2025 -

`

Homeownership vs. Real Estate Investment: What’s Better?

Homeownership has long been seen as the American dream. But today, more people are asking: Is it really the smartest way...

October 3, 2025 -

`

Why the Armani Fashion Empire Is Set for an IPO

Giorgio Armani, one of the most iconic names in global fashion, left behind a detailed plan for the future of his...

September 27, 2025 -

`

Why Do Pokémon Cards Outperform the S&P 500 As an Investment?

Pokémon cards have outperformed the stock market by a mile. Since 2004, they have delivered a staggering 3,821% return, according to...

September 27, 2025 -

`

America’s Billionaires Get Older—Millennials Wait for Wealth Transfer

Many of today’s billionaires don’t match the youthful tech-founder image often portrayed. While names like Elon Musk, Sam Altman, and Mark...

September 21, 2025 -

`

Can President Trump Legally Fire Fed Governor Lisa Cook?

Lisa Cook is right in the middle of one of the most explosive legal battles in Washington. President Trump wants her...

September 20, 2025 -

`

Jeff Bezos’ Advice for Millennials Who Want Financial Success

Millennials today have grown up in a world where instant access to products and services is the norm. From two-day deliveries...

September 13, 2025

You must be logged in to post a comment Login