Why Millionaires Are Still Working In Their Retirement Age

For many people, becoming a millionaire is synonymous with early retirement and leisure. However, the reality is that many millionaires will have to work longer than planned due to several factors.

The Cost of Living

One of the biggest reasons why millionaires will have to work longer than planned is the cost of living. While having a million dollars in the bank might seem like a lot of money, the truth is that it can disappear quickly when you factor in the high cost of living in many cities worldwide.

Paul/ Getty Images | Inflation has been adversely affecting commoners and old people

For example, if you live in a major city like New York or London, housing, food, transportation, and other expenses can easily eat away at your savings. In addition, taxes can take a significant chunk of your income, leaving you with less money to save for retirement. As a result, many millionaires will have to work longer than planned to continue building their nest egg and ensure they have enough money to support themselves in retirement.

The Rise of Healthcare Costs

Another factor that can impact a millionaire’s retirement plans is the rising cost of healthcare. As we age, our healthcare needs tend to increase, and the cost of medical care can be prohibitively expensive, even for those with significant wealth.

According to a study by Fidelity, a couple retiring at age 65 in 2021 can expect to spend an average of $300,000 on healthcare throughout their retirement. This figure does not include long-term care, which can add another $100,000 or more to the total cost. For many millionaires, these healthcare costs can eat away at their retirement savings, forcing them to continue working to pay for their medical expenses.

Justin Varghese/ Shutterstock | A higher cost of living means that basic expenses have become expensive

Uncertainty in the Market

Another reason why millionaires will have to work longer than planned is the uncertainty of the stock market. While investing in the stock market can be a great way to build wealth over the long term, it’s also subject to market fluctuations and unpredictable events.

For example, a recession or economic downturn can significantly impact a millionaire’s portfolio, leading to significant losses in a short period. In addition, geopolitical events such as wars or political upheavals can cause markets to become volatile, making it difficult to predict how investments will perform.

The Need for Purpose and Meaning

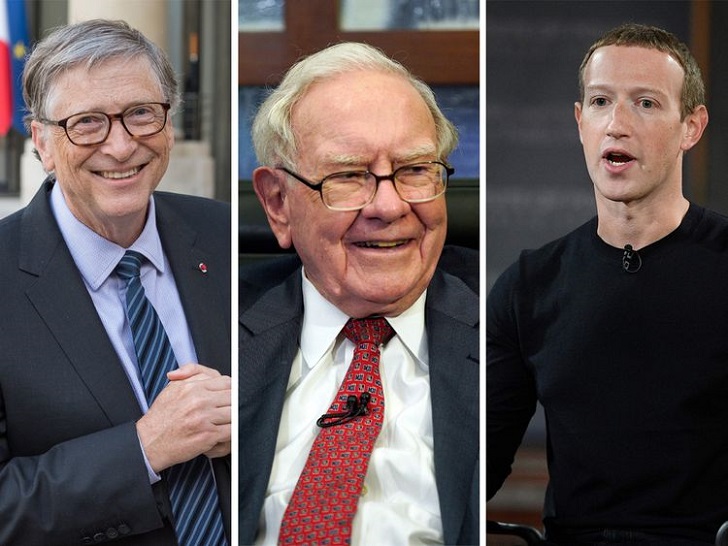

AP/ Shutterstock | Work is a lifelong pursuit that brings joy, satisfaction, and a sense of purpose to life

Finally, many millionaires will have to work longer than planned simply because they find their work fulfilling and meaningful. While financial security is certainly a goal for many people, it’s not always enough to provide a sense of purpose and direction.

Many millionaires’ work is a source of pride and accomplishment, and they derive great satisfaction from their careers. They may continue working to pursue new challenges, positively impact the world, or simply because they enjoy what they do. In some cases, this drive to continue working can be positive, providing a sense of purpose and motivation that can help keep millionaires engaged and fulfilled throughout their lives.

More in Investments

-

`

Matthew Perry Foundation Launches Addiction Fellowship at MGH

The impact of addiction on individuals and families is profound, and the need for specialized medical care in this field has...

February 13, 2025 -

`

Celebrity Couples Who Have Ended Their Relationships in 2025

2025 has already seen its fair share of celebrity breakups, and the year is just getting started. From heartfelt announcements to...

February 6, 2025 -

`

How Trump’s Policies Will Reshape Artificial Intelligence in the U.S.

The United States witnessed a significant political shift as Donald Trump took the presidential oath once again. His return to the...

January 31, 2025 -

`

Millie Bobby Brown Shuts Down Age-Shamers with a Powerful Message

From the moment Millie Bobby Brown first appeared as Eleven in “Stranger Things,” she captured hearts worldwide. But growing up in...

January 25, 2025 -

`

Why Outsourcing Payroll Services Is a Smart Business Move

Managing payroll is no small task—it’s a crucial part of any business that ensures employees are paid accurately and on time....

January 15, 2025 -

`

These AI Stocks Should Be on the Watch List of Investors in 2025

The buzz around AI stocks is growing louder than ever. With artificial intelligence shaping industries like healthcare, finance, and tech, smart...

January 8, 2025 -

`

Why the Starbucks Workers Strike Is Expanding Across U.S. Cities

The Starbucks workers’ strike has gained significant momentum, with employees in more U.S. cities joining the movement to address unresolved issues...

January 2, 2025 -

`

Are Shawn Mendes and Camila Cabello Still Close After Breakup?

The connection between Shawn Mendes and Camila Cabello continues to intrigue fans worldwide. Their shared history, from chart-topping collaborations to a...

December 24, 2024 -

`

Here’s What It Takes to Become a Professional Physical Therapist

Physical therapy is a career that blends science, empathy, and problem-solving to help people recover from injuries or improve mobility. Knowing...

December 19, 2024

You must be logged in to post a comment Login