Consumer Guide On Philippine President Duterte’s TRAIN Law

One of the main priorities and propaganda of Philippine President Rodrigo Duterte, when he was still a presidential candidate, was to lower, if not exempt, the middle-class workers from the hefty amount of tax they’re paying to the government. Most middle-class earners make an annual income of 100,000 PHP to 250,000PHP, and even that amount isn’t enough to support their lives and pay the bills and responsibilities making the country a perfect holiday for many – but a tough environment to grow business. That’s why when he became the president, he made it his personal mission to realize the tax exemption scheme for the middle-class earners. Hence, the realization of the Comprehensive Tax Reform for Acceleration and Inclusion Program, also known as the TRAIN LAW.

How does the TRAIN Law Benefit the Filipino People?

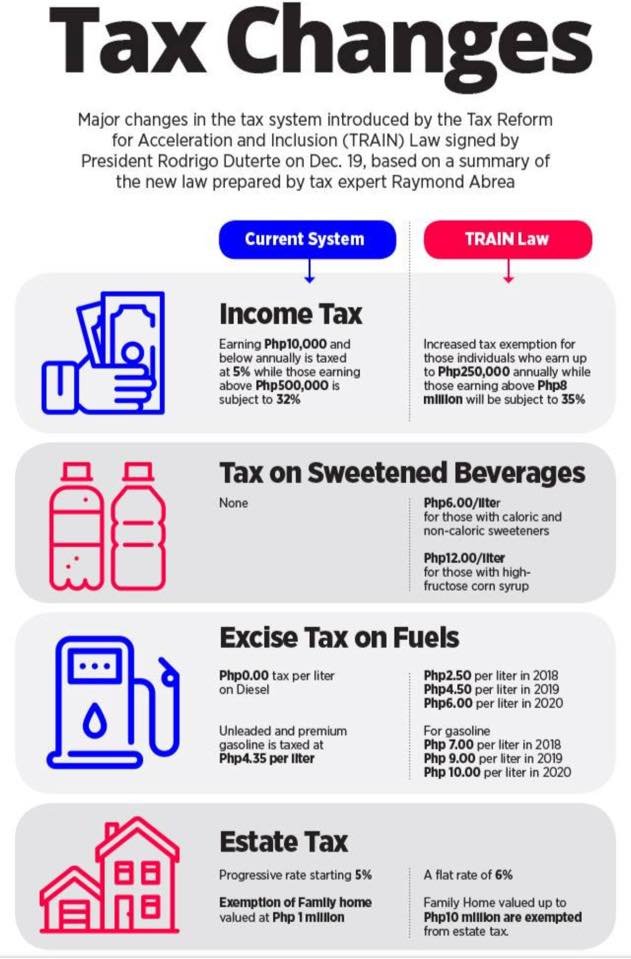

The main purpose of the TRAIN law was to exempt the middle-class earners from paying taxes to the government. When the law was passed, the government and the Congress delivered the good news that around 7 million of the Philippine population is eligible for tax exemption. For example, if you’re earning a monthly income of 20,000PHP, you need to pay an income tax of around 2,684 PHP per month, or around 32,000 PHP annually. However, thanks to the newly passed TRAIN law, an employee can now get an additional take-home pay of 2,600 pesos per month because of the tax exemption.

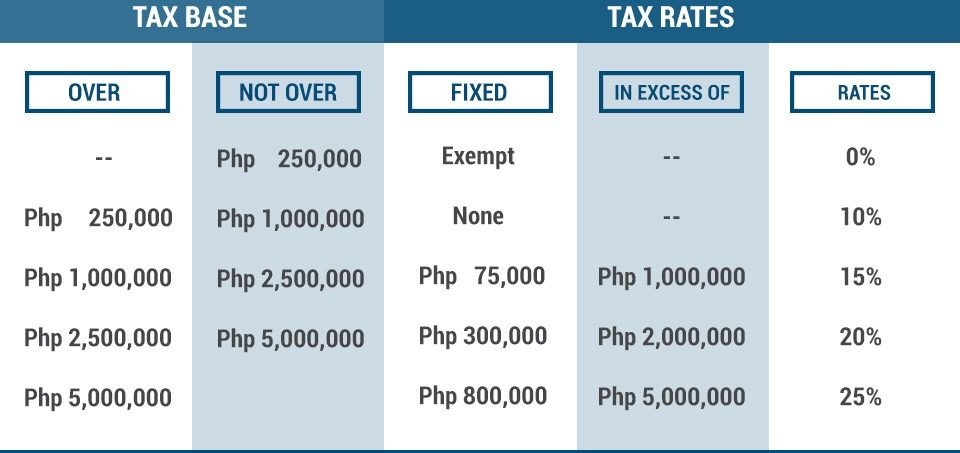

Newly Implemented Tax Scheme for Employees

Everybody should be happy about this new tax scheme, right? Not so fast. Why? It’s because the public draws in mixed emotions about the TRAIN law. Why, do you ask? It’s because the government still needs to perform check and balance to somehow gain what they’ve lost. And that’s where the excise tax for other commodities comes in. Included in the TRAIN law was the tax impose of fuel, cars, real estate, etc. These excise taxes, especially in fuel, may create a domino effect, leading to increased prices on all goods and commodities which may burden the public, especially to those minimum-wage earners who are already exempted from the former tax scheme.

Excise Tax on Commodities

For those who didn’t know about the new tax scheme yet, we offer you this comprehensive guide in order to prepare yourself for the possible adjustments you may have to implement your budget.

Sugary Beverages

Comprehensive Guide to TRAIN Law Infographic

If you’re fond of eating junk food and drinking soft drinks or energy drinks, then you might want to limit your sugar consumption because the TRAIN law imposed a tax on these sweetened beverages. About 6 PHP/liter will be imposed on caloric and non-caloric sweeteners. While an additional 12 PHP/liter for those beverages produced from corn syrup. This means that if a soft drink cost around 25 PHP before, the prices would go up to 36 PHP starting 2018. Before you buy a drink, we recommend you to think twice if you can afford it with your current budget. The benefits of this imposed tax law on beverage though are that you get to limit your sugar consumption. Thus, it makes you healthier since you’re able to regulate your blood sugar.

Fuel and Petroleum Products

The imposed excise tax on fuel and petroleum products dreaded the public because it can create domino effects to basic goods and commodities. Since the mode of transportation purely relies on fuel, the public is wary that it the businesses and firms may increase their prices on all their products and items because of the fuel excise tax. Under the TRAIN law, there will be an increase of 2.50 PHP/liter for fuel products. And that’s not the end of it because for the next succeeding years, it’ll continue to increase as the new packages of tax reform law gets passed to the Congress.

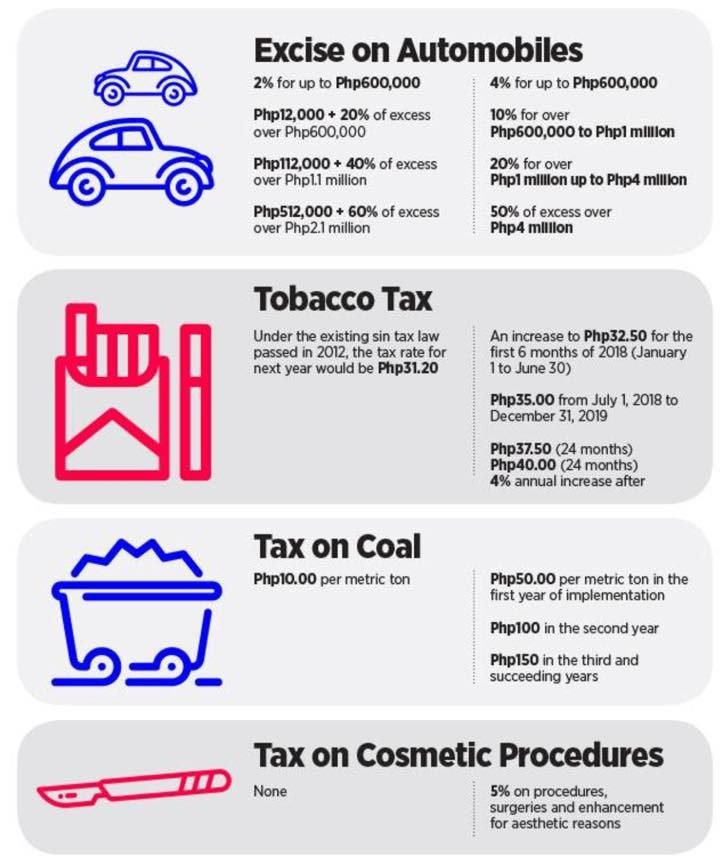

Excise Tax on Cars and Real Estate

Comprehensive Guide to TRAIN Law Infographic Part 2

If you’re looking to buy your dream car or real estate, then we also recommend you to include the excise tax in your budget. According to the TRAIN law, there will be a flat rate of 4% if the value of your car exceeds to 600,000 PHP, and the percentage continues to increase as the value of your car increases. While on real estate, there will be a corresponding flat rate of 6% estate tax for your property. The good thing though is that any family home value that is below 10 million pesos after you pay the 6% flat rate.

More in Advisor

-

`

Matthew Perry Foundation Launches Addiction Fellowship at MGH

The impact of addiction on individuals and families is profound, and the need for specialized medical care in this field has...

February 13, 2025 -

`

Celebrity Couples Who Have Ended Their Relationships in 2025

2025 has already seen its fair share of celebrity breakups, and the year is just getting started. From heartfelt announcements to...

February 6, 2025 -

`

How Trump’s Policies Will Reshape Artificial Intelligence in the U.S.

The United States witnessed a significant political shift as Donald Trump took the presidential oath once again. His return to the...

January 31, 2025 -

`

Millie Bobby Brown Shuts Down Age-Shamers with a Powerful Message

From the moment Millie Bobby Brown first appeared as Eleven in “Stranger Things,” she captured hearts worldwide. But growing up in...

January 25, 2025 -

`

Why Outsourcing Payroll Services Is a Smart Business Move

Managing payroll is no small task—it’s a crucial part of any business that ensures employees are paid accurately and on time....

January 15, 2025 -

`

These AI Stocks Should Be on the Watch List of Investors in 2025

The buzz around AI stocks is growing louder than ever. With artificial intelligence shaping industries like healthcare, finance, and tech, smart...

January 8, 2025 -

`

Why the Starbucks Workers Strike Is Expanding Across U.S. Cities

The Starbucks workers’ strike has gained significant momentum, with employees in more U.S. cities joining the movement to address unresolved issues...

January 2, 2025 -

`

Are Shawn Mendes and Camila Cabello Still Close After Breakup?

The connection between Shawn Mendes and Camila Cabello continues to intrigue fans worldwide. Their shared history, from chart-topping collaborations to a...

December 24, 2024 -

`

Here’s What It Takes to Become a Professional Physical Therapist

Physical therapy is a career that blends science, empathy, and problem-solving to help people recover from injuries or improve mobility. Knowing...

December 19, 2024

You must be logged in to post a comment Login