Financial Advisers Advise Their Clients To Prepare For The U.S. Tax Reform

The package of tax reform is said to aim at fixing the broken system and the undersigned have one shared perspective about this: There will be an acceleration in economic growth if the Jobs Acts and Tax Cuts pass. This will lead to a progressive economic effect: increase of employment, higher wages, and a better way of living for the people of the United States. On the other hand, the failure of the bill would mean risks of the continued economic underperformance of America. The U.S. is not as strong as it was and economically speaking, it is incompetent.

What Happened To the United States?

Why is U.S. economy not competitive?

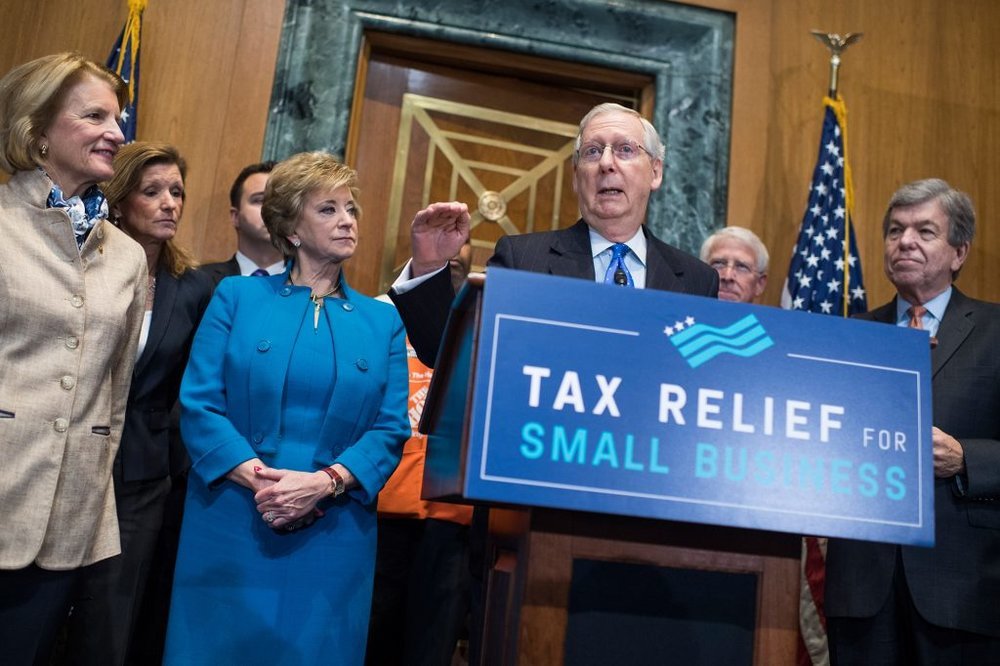

Senate Republicans are Confident that they have enough support to pass the tax bill

The corporate tax rate is untouched virtually for more than three decades until it topped the chart and recorded as the highest in the industrialized world above the OECD average by 15 percent. The loss of economic edge had led to forfeiting 4,700 companies from 2004 until 2017 to cheaper ones abroad. America took it slow while everyone else in the world took different steps to lower their corporate rates and even to a point of lowering the wages of American workers and cutting them off by thousands of dollars annually.

Regardless of support or direct opposition to the present plan, the current record-breaking rate at which the U.S. taxes creating jobs should be acknowledged. Taking action on the comprehensive overhaul will ignite the U.S. economy with growth levels not seen for generations. It would help produce a boost in GDP between 3 and 5 percent. The debate about it examines the deficit implications. It is important to consider the $1 trillion new revenues for the federal government which is four-tenths of a percentage of the growth in GDP.

The financial advisors are warning clients to be cautious about making big moves in swaying tax bills until the Congress finalize the cuts in taxes as well as the Jobs Act.

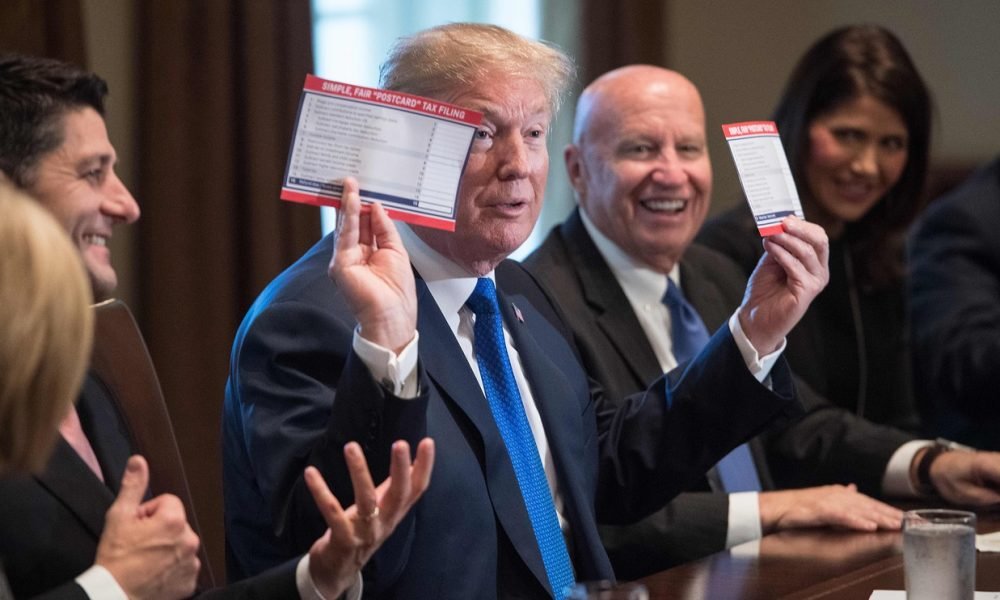

On Friday, Senate Republicans verbally expressed their confidence on having the support they need to pass the proposed tax bill. When that happens, the Senate and the House will need to meet halfway and settle the differences in their bills prior to presenting the final version to President Trump.

There was a statement by financial advisors that the uncertainty about what might or might not make it to the ultimate bill would mean that the consumers should tread carefully. According to Erika Safran, certified financial planner and founder of Safran Wealth Advisors in New York, it would be hard to reconcile doing something that would be financially damaging if some particular change doesn’t go through. You have got nimble.

How Advisors Tell Clients To Prepare For Tax Reform

Financial Advisers Told their Clients to Prepare for Impending Tax Reform

Consumers should focus on the current tax law when it comes to making the year-end moves to cut their tax bill according to financial advisors. Only until there is a final version of the said bill that you are advised to have a consultation with your accountant and advisor.

The best advice is to focus on taking actions that would advance your overall financial situation regardless of the changes in legislation. Such moves could be done by pre-tax max out of contributions to your 401 (k) plan and extend donations to charities.

Safran even added that it would be good to do all the things you can within the present framework.

US Middle-Class Workers Are Protesting Against the Tax Reform Bill

Kevin Meehan, the regional president for Wealth Enhancement Group in Itasca, lll, and a certified financial planner, said that once the final version of the reform bill on tax is finished, you should be quick in coordinating with your tax professional and financial advisor. They will be able to run some projections that could determine how provisions in tax reforms would be able to affect you.

You are going to have to watch out the main areas. Ask which is better: should you accelerate income, defer, or deduct? These are just some of the advice people like Meehan does. There is a possibility for last-minute moves to make before the year ends depending on the timing. Barry Glassman, founder, and president of Glassman Wealth Services in Vienna, Va, said that there could also be a shift in strategies in going forward. You’re going to have to move quickly. As soon as you know what you have, what do you do about it?

More in Advisor

-

`

Matthew Perry Foundation Launches Addiction Fellowship at MGH

The impact of addiction on individuals and families is profound, and the need for specialized medical care in this field has...

February 13, 2025 -

`

Celebrity Couples Who Have Ended Their Relationships in 2025

2025 has already seen its fair share of celebrity breakups, and the year is just getting started. From heartfelt announcements to...

February 6, 2025 -

`

How Trump’s Policies Will Reshape Artificial Intelligence in the U.S.

The United States witnessed a significant political shift as Donald Trump took the presidential oath once again. His return to the...

January 31, 2025 -

`

Millie Bobby Brown Shuts Down Age-Shamers with a Powerful Message

From the moment Millie Bobby Brown first appeared as Eleven in “Stranger Things,” she captured hearts worldwide. But growing up in...

January 25, 2025 -

`

Why Outsourcing Payroll Services Is a Smart Business Move

Managing payroll is no small task—it’s a crucial part of any business that ensures employees are paid accurately and on time....

January 15, 2025 -

`

These AI Stocks Should Be on the Watch List of Investors in 2025

The buzz around AI stocks is growing louder than ever. With artificial intelligence shaping industries like healthcare, finance, and tech, smart...

January 8, 2025 -

`

Why the Starbucks Workers Strike Is Expanding Across U.S. Cities

The Starbucks workers’ strike has gained significant momentum, with employees in more U.S. cities joining the movement to address unresolved issues...

January 2, 2025 -

`

Are Shawn Mendes and Camila Cabello Still Close After Breakup?

The connection between Shawn Mendes and Camila Cabello continues to intrigue fans worldwide. Their shared history, from chart-topping collaborations to a...

December 24, 2024 -

`

Here’s What It Takes to Become a Professional Physical Therapist

Physical therapy is a career that blends science, empathy, and problem-solving to help people recover from injuries or improve mobility. Knowing...

December 19, 2024

You must be logged in to post a comment Login