Life-Changing Ideas to Help You Not Go Broke in Your Retirement Days

Life after retirement

Spending years to work for a company is a noble course, if we put aside the monetary gains in form of wages for the employees. Fortunately, the working period for a worker will eventually come to an end, which means that retirement time is inevitable. Financial advisers have formulated several basic ideas which estimate the required earnings that will be needed during this life phase.

One of the most famous rules is the ’70 percent law’ which says that retired employees will have to trade 70 percent out of their working wages for the provision of basic needs during retirement. However, with the current trend in the economic situation and modern rules, that idea is fast losing its reliability, abiding by such principle may be disastrous. This harsh but true reality is because things have changed in today’s world of the labor market.

The truth is, the 70% guideline doesn’t hold water anymore in today’s world for retirees

Older days vs modern time

Life expectancy has reduced to an average 63-year-old men who may be given at most, another 21 years to stay alive, while females are given at most 28 years more, but things were better in the 70s.

The number of retired, aged people who will eventually need medical attention for many years, have increased to 7 out of 10 cases. A handful of modern-day retirees live in a sea full of debt. Such debt may be education loans, mortgages or utility bills. Notwithstanding, retirees still expend the exceedingly high amount of money on feeding, transportation, and accommodation.

In the medical sector, the costs have become lower than before, but the current level of financial demands is still not very affordable for many due to inflation. The majority of the retirees may find the ’70 percent’ law appealing when planning, but with the combination of prolonged hazards for older people and the tendency for inflation, it’s hard to achieve that. Some retired workers may need to use 100 percent of their wages to make the rule applicable.

In spite of the above-mentioned demerits, there is still hope after all for workers who want to live a post-service life of financial comfort. Below are four things to do in the last 15 years before hitting the retirement days that can literally save your life:

Keep tabs on your current spending

Now and not tomorrow, not even next week! Start monitoring your spending and financial responsibilities this very minute, then little by little, amend your expenses in such a way that you can be able to survive with only 70 percent or less of your total income.

Economic hardships are common among retirees who don’t financially prepare themselves for their lifestyle expenses, income, and rainy days

Practice a lifestyle of a retiree

Make the effort to change your lifestyle in the same style you would likely live when you retire for at least a week. You can start by making a list before hitting the grocery store, cutting down on your recreational vacations, living a humble life free of expensive cars which cost more to maintain, etc. Basically, you just need to learn how to better control your money, the way you spend your free time and also, to reduce the amenities that you don’t really need.

Save more

If you diligently follow the two aforementioned steps, then you must surely have accumulated a substantial uptick in your savings. So, the best thing to do now is to pack everything into your savings bank account for raining days, aka your retirement days.

Begin to use your Social Security rewards

Social Security is very important and retirees can put their own privileges for their account on hold till they clock 70 years old. Your goals for retirement will be formed through the demands of your compulsory needs, principles, and behavior. These goals will lie in your heart, and this will no doubt transform your mindset.

More in Advisor

-

`

Google’s Antitrust Trial Over ‘Ad Monopoly’ Nears Critical Verdict

Google’s trial has captured headlines as it reaches its dramatic conclusion. The U.S. Justice Department (DOJ) argues that Google’s dominance in...

December 5, 2024 -

`

Christopher Nolan’s New Movie Set to Star Robert Pattinson in Lead

Christopher Nolan’s new movie, following their collaboration on Tenet, will reunite the acclaimed director with Robert Pattinson. Known for pushing creative...

November 29, 2024 -

`

Princess Kate’s ‘Secret’ Hobby That Prince William Has ‘No Idea’ About

When you think of royalty, images of glamorous events and stately duties likely come to mind. But Princess Kate’s secret hobby...

November 26, 2024 -

`

Are You Ready for the 2025 Tax Brackets?

With the IRS’s recent update to the 2025 tax brackets, understanding how these adjustments impact you is more important than ever....

November 21, 2024 -

`

What Does the Autumn UK Budget Mean for the Bond Market Market?

The Autumn UK budget and the bond market are two areas intertwined with high stakes for the economy. This year, Chancellor...

November 13, 2024 -

`

Is Bruce Springsteen a Billionaire? Here’s Why He Rejects the Label

Bruce Springsteen’s billionaire claims have recently gained attention, with Forbes announcing his induction into the billionaire club in July 2024. Forbes...

November 7, 2024 -

`

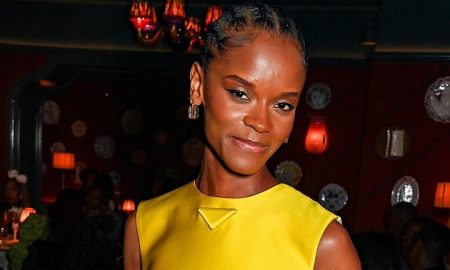

“Black Panther” Star Letitia Wright Wows in ‘Chic’ Mini-Prada Dress at the Blacklisted Dinner

Letitia Wright stunned fashion lovers once again when she attended The Blacklisted Dinner in October 2024 in London. The prestigious event,...

October 29, 2024 -

`

How Will the Business Ownership Information Report Affect Business Operations?

Recently, a significant change has emerged for businesses in the U.S. The Financial Crimes Enforcement Network (FinCEN) has introduced the Business...

October 23, 2024 -

`

Tajikistan’s ‘Strategic Tourism Investment’ Make It One of the Go-to Destinations For Tourists

Strategic tourism is emerging as a powerful force in Tajikistan, driving economic transformation with remarkable potential. With its dramatic landscapes, rich...

October 18, 2024

You must be logged in to post a comment Login