Looking For Financial Wellness? You Can’t Miss These Money Moves By Mark Cuban

It’s not uncommon to come across stories about billionaires that depict the struggle they went through during their earlier days. And while each one of them had a different road to financial wellness, one thing that’s common in every story is the determination that led these people to the success they enjoy today.

One such billionaire is Mark Cuban. Despite the happy image that he projects today, Cuban has seen days of utter struggle. In fact, up until 1990 when he sold his start-up, MicroSolutions, for $6 million, he never felt financially stable. How he managed through tough times and what money lessons he learned are worth discussing.

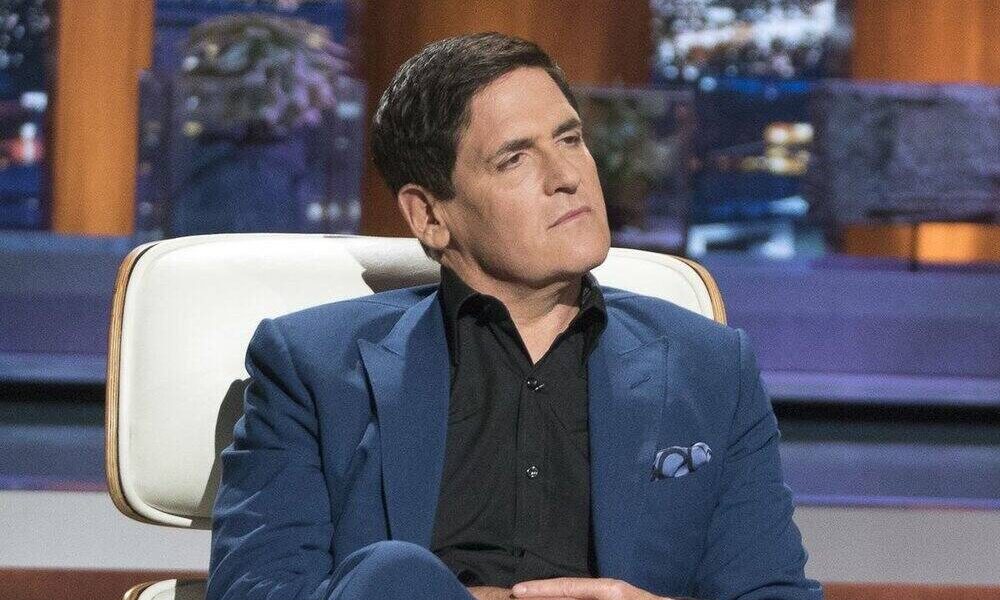

Getty Images | Billionaire Mark Cuban’s financial tips are worth following

If you too, are looking for financial wellness, these key pieces of financial advice shared by him are sure to help you.

Read – This is the advice Mark Cuban would give his 20-year-old self

Try not accumulating credit card debts

Cuban believes that it’s okay to use a credit card, but only if you pay off the bill at the end of every month. The roughest lesson he learned was getting his credit cards ripped up because of accrued credit card interest.

Yes, credit cards are helpful if you want to make a huge payment, say for buying a house, as mortgage rates are low and houses can appreciate. But it’s of no use if you don’t pay the bill off at the end of the month. All in all, the smartest investment that you can make is to not use a credit card at all or pay the bill after every 30 days.

Unsplash | One of the first things we should do is stop credit card debts from piling up

Buy in Bulk

We often come across deals on online e-commerce platforms like Amazon. Cuban advises to make use of such deals and buy consumables, clothes, or even electronics. This way you will save almost 30 to 40 percent on every purchase, which can amount to several hundred dollars over a period of a few months. While it may be difficult to put aside money every month for savings or investments, saving in this way over regular shopping is easier and smarter.

Read – Americans spend over $5000 a year on groceries

Don’t buy things you can’t afford

The last tip of the “Shark Tank ” investor is to live as if you’re a student; meaning that you don’t need to buy everything, especially the stuff you can’t afford! It’s better to put more money in your bank as that will put you in a more decent position in the future.

Unsplash | Cuban suggests living like a student – keeping away from stuff you can’t afford

To sum it up

You don’t need a fancy degree or a special background to manage your finances well. All you need is a bit of smart thinking and good decision making. Learning from the advice given by billionaires like Mark Cuban can help you become financially prosperous. Saving money on the things you don’t need, buying the necessary things in bulk, and paying off your credit card debts on time can surely help you to have a smoother financial track.

More in Advisor

-

`

Matthew Perry Foundation Launches Addiction Fellowship at MGH

The impact of addiction on individuals and families is profound, and the need for specialized medical care in this field has...

February 13, 2025 -

`

Celebrity Couples Who Have Ended Their Relationships in 2025

2025 has already seen its fair share of celebrity breakups, and the year is just getting started. From heartfelt announcements to...

February 6, 2025 -

`

How Trump’s Policies Will Reshape Artificial Intelligence in the U.S.

The United States witnessed a significant political shift as Donald Trump took the presidential oath once again. His return to the...

January 31, 2025 -

`

Millie Bobby Brown Shuts Down Age-Shamers with a Powerful Message

From the moment Millie Bobby Brown first appeared as Eleven in “Stranger Things,” she captured hearts worldwide. But growing up in...

January 25, 2025 -

`

Why Outsourcing Payroll Services Is a Smart Business Move

Managing payroll is no small task—it’s a crucial part of any business that ensures employees are paid accurately and on time....

January 15, 2025 -

`

These AI Stocks Should Be on the Watch List of Investors in 2025

The buzz around AI stocks is growing louder than ever. With artificial intelligence shaping industries like healthcare, finance, and tech, smart...

January 8, 2025 -

`

Why the Starbucks Workers Strike Is Expanding Across U.S. Cities

The Starbucks workers’ strike has gained significant momentum, with employees in more U.S. cities joining the movement to address unresolved issues...

January 2, 2025 -

`

Are Shawn Mendes and Camila Cabello Still Close After Breakup?

The connection between Shawn Mendes and Camila Cabello continues to intrigue fans worldwide. Their shared history, from chart-topping collaborations to a...

December 24, 2024 -

`

Here’s What It Takes to Become a Professional Physical Therapist

Physical therapy is a career that blends science, empathy, and problem-solving to help people recover from injuries or improve mobility. Knowing...

December 19, 2024

You must be logged in to post a comment Login