How To Protect Yourself In Stock Scams And Frauds

There are people who will try to rip others off for their own benefits. They usually make a parasitic relationship with good business ideas and then exhaust the life out of it. They do this very often until people slowly lose all their faith in these ideas.

The stock market, no matter how established it is, also has its fair share in scams and frauds. These scammers use a person’s desperation to become rich and since the stock market is not taught in our basic education, we really don’t have a solid background on this. Learning about it can be very hard, as they use different terms and the concept is puzzling, at first. Scammers use our naivety and our dream of becoming rich against us for their own selfish motives.

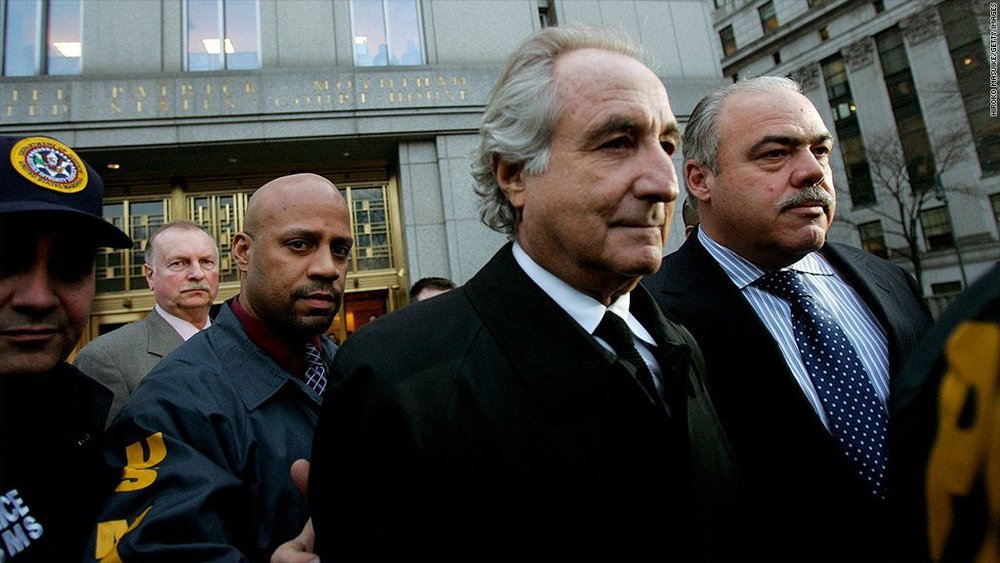

Bernie Madoff is a fraudster and a former investment advisor behind the Ponzi Scheme

Stock market scams have one thing in common, and that is the promise of very high returns. They use our greed against our rationality to get what they want.

But there are easy ways to determine these tactics. Let’s be vigilant so that our hard-earned money will not turn into dust. Follow these tips to keep all those scammers at bay.

Do the research

A person who knows what he’s getting into is less likely to get fooled. That is why it’s very important to make an exhaustive research before diving into this risky business. Companies who sell stocks put all the information on their website. Companies who don’t disclose their wealth, sales, and revenues are usually up to no good. Contacting a financial adviser or a stock analyst for recommendations is also a smart move. Take advantage of the technology and fast internet. All the answers are just at the tip of our fingers.

The Inside Job

Scammers give generous and too-good-to-be-true deals. This is their main tactic to encourage the buyers to invest their money. They use taglines such as “get your money back” or “guaranteed money back” to give us the feeling that we have all the control in these investments. A promise of being instantly rich is also their way to trigger our desperation. Logically speaking, why would they eagerly want to sell their shares if it can transform anyone to become a millionaire? Wouldn’t they want to keep it instead of giving the key to the paradise?

Never be too trusting

Our brain is not as powerful as we thought. Despite being skeptics, there are sometimes that we get carried away by good sales talk. This is why our consumerist behavior is the best capital that industries are banking on. We get attracted easily to concepts of weight loss, anti-aging, and becoming a millionaire. No wonder these scammers are on a roll.

Invest in companies that are transparent in their movement

Being skeptical in business and stock markets is usually a good trait that can protect us from losing all our money. When planning to buy a stock, it’s important not to get too personal with the person on the other side of the coin. This is so we can shield ourselves from being persuaded by the sellers. Maintain a safe and professional distance to get a clearer picture of the deal itself. Be a skeptic and be vigilant. This goes back to our first tip, do the research.

Work with a professional

There is a reason why we call them professionals. Financial analysts and advisors have been in the industry for years. As what the saying goes, “wisdom comes with age” and that age will work to our advantage. Sure, hiring a professional is an additional expense but it can help us avoid losing our money if invested in a wrong stock.

Suze Orman is one of the best financial advisors working in Merril Lynch

There are also many seminars that help beginners understand the world of stock and trading. These seminars will give us an idea and inside tips on how to excel in the industry. A seminar fee and a professional help is just a small price to pay compared to being ripped off in the long run.

There are many ways to prosper in the stock and trading industry. But one thing for sure, there are no shortcuts. We have to undergo each step and process to get the most out of our investments. Wanting instant results will soon end up in a crash.

More in Advisor

-

`

Why the Armani Fashion Empire Is Set for an IPO

Giorgio Armani, one of the most iconic names in global fashion, left behind a detailed plan for the future of his...

September 27, 2025 -

`

Why Do Pokémon Cards Outperform the S&P 500 As an Investment?

Pokémon cards have outperformed the stock market by a mile. Since 2004, they have delivered a staggering 3,821% return, according to...

September 27, 2025 -

`

America’s Billionaires Get Older—Millennials Wait for Wealth Transfer

Many of today’s billionaires don’t match the youthful tech-founder image often portrayed. While names like Elon Musk, Sam Altman, and Mark...

September 21, 2025 -

`

Can President Trump Legally Fire Fed Governor Lisa Cook?

Lisa Cook is right in the middle of one of the most explosive legal battles in Washington. President Trump wants her...

September 20, 2025 -

`

Jeff Bezos’ Advice for Millennials Who Want Financial Success

Millennials today have grown up in a world where instant access to products and services is the norm. From two-day deliveries...

September 13, 2025 -

`

Maison Margiela’s First-Ever Celebrity Campaign Stars Miley Cyrus

Miley Cyrus just changed the rules again. In August 2025, she became the first celebrity ambassador in Maison Margiela’s 37-year history....

September 12, 2025 -

`

Should You Rely on AI for Financial Advice? Here’s What Financial Experts Say

AI is everywhere right now, and yes, that includes your wallet. From budgeting to retirement planning, tools like ChatGPT, Google Gemini,...

September 6, 2025 -

`

95% of Businesses Report Zero Returns on In-House AI, MIT Study Shows

U.S. companies have funneled an estimated $35 to $40 billion into internal AI projects. Yet according to a new report from...

September 6, 2025 -

`

Why Americans in Their 80s Are Still Job Hunting

Charles Meoni, at 82 years old, believes he still has the skills to drive an 18-wheeler. Yet he faces rejection after...

August 30, 2025

You must be logged in to post a comment Login