These Proven Strategies Will Make Sure You Never Run Out of Money

Saving for retirement is a daunting task. With a lot of things to consider, it can be tempting to put off planning for it. The good news is that there are plenty of strategies that can simplify and keep the process low-cost for you.

The American College of Financial Services professor Wade Pfau has come up with an optimal retirement strategy that focuses on just two concepts: Social Security and investments. Let’s find out how it works.

Social Security as ‘Floor Income’

Wavebreakmedia/Deposit Photos — Pfau’s strategy means that you’ll use your Social Security benefits to pay for the majority of your bills and expenses

The first and most important component of Pfau’s strategy is maximizing your Social Security benefits so you can rely on it to become your ‘floor income’ in retirement. He sees Social Security as the foundation of retirement for retirees who belong in the middle-income category, which includes those with $100,000 up to $1 million in savings.

These benefits would ideally cover about three-fourths of a retirees’ income. To see how much income you’d need in retirement, calculate all of your essential expenses from housing to utilities to food.

Another recommended move experts have for future retirees is to wait until they’re 70 before accessing their Social Security benefits even though they can start getting it at 62. Doing so would increase the monthly sum they’d receive.

Investing for the Fun Stuff

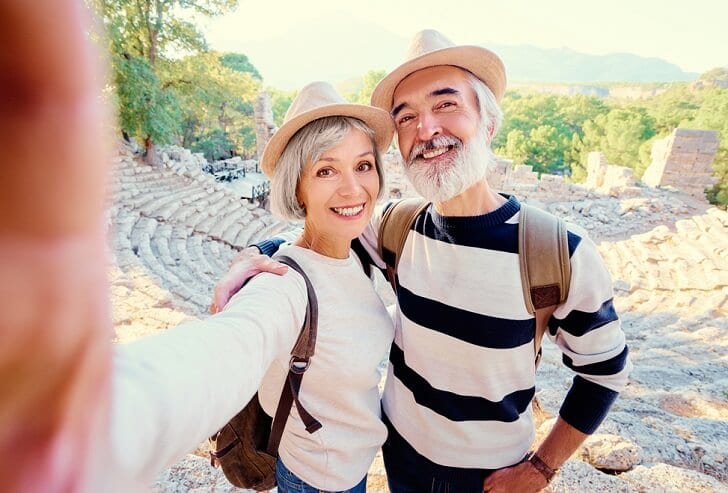

kudla/Shutterstock — Investment earning can fund your ‘fun’ expenses like traveling

The second component of Pfau’s investment strategy is your investment portfolio. Since these liquid savings aren’t earmarked to pay for your necessities, you can invest them in more aggressive instruments that offer higher returns.

A mutual fund that tracks the stock market is a recommended investment vehicle in this case. Of course, you can also err on the safer side and choose a more conservative type of mutual funds such as those that invest 50% on bonds and 50% on stocks.

Once you’ve set up your investments, the next thing you should determine is how much you can withdraw each year to make your money last. A useful guide is the IRS’ required minimum distribution worksheet.

Having a Transition Fund

szefei/Shutterstock — The average fiftysomething has a median retirement savings of $117,000

Aside from following the two-pronged strategy proposed by Pfau, you may also want to create a transition fund. This would benefit those who find themselves needing to retire earlier than they planned.

You can take out this fund from your investment portfolio and use it to cover your expenses until you start claiming your Social Security checks at age 70, as recommended. Make sure to put this fund on safer investments like a short-term bond fund or a money market mutual fund.

More in Advisor

-

`

Matthew Perry Foundation Launches Addiction Fellowship at MGH

The impact of addiction on individuals and families is profound, and the need for specialized medical care in this field has...

February 13, 2025 -

`

Celebrity Couples Who Have Ended Their Relationships in 2025

2025 has already seen its fair share of celebrity breakups, and the year is just getting started. From heartfelt announcements to...

February 6, 2025 -

`

How Trump’s Policies Will Reshape Artificial Intelligence in the U.S.

The United States witnessed a significant political shift as Donald Trump took the presidential oath once again. His return to the...

January 31, 2025 -

`

Millie Bobby Brown Shuts Down Age-Shamers with a Powerful Message

From the moment Millie Bobby Brown first appeared as Eleven in “Stranger Things,” she captured hearts worldwide. But growing up in...

January 25, 2025 -

`

Why Outsourcing Payroll Services Is a Smart Business Move

Managing payroll is no small task—it’s a crucial part of any business that ensures employees are paid accurately and on time....

January 15, 2025 -

`

These AI Stocks Should Be on the Watch List of Investors in 2025

The buzz around AI stocks is growing louder than ever. With artificial intelligence shaping industries like healthcare, finance, and tech, smart...

January 8, 2025 -

`

Why the Starbucks Workers Strike Is Expanding Across U.S. Cities

The Starbucks workers’ strike has gained significant momentum, with employees in more U.S. cities joining the movement to address unresolved issues...

January 2, 2025 -

`

Are Shawn Mendes and Camila Cabello Still Close After Breakup?

The connection between Shawn Mendes and Camila Cabello continues to intrigue fans worldwide. Their shared history, from chart-topping collaborations to a...

December 24, 2024 -

`

Here’s What It Takes to Become a Professional Physical Therapist

Physical therapy is a career that blends science, empathy, and problem-solving to help people recover from injuries or improve mobility. Knowing...

December 19, 2024

You must be logged in to post a comment Login