Save More Money By Paying Your State Taxes Ahead

Who doesn’t want to save money and spend it on things that matter more than taxes? Taxes are great, we get benefits provided by the government thanks to them but given the chance that we could save money if we don’t pay loads of cash, we would set an additional budget for other things like savings and other bills we need to take care of. So, how to do it?

Did you know that one way of saving some cash is an advance payment? You might save some money and use it for other important things.

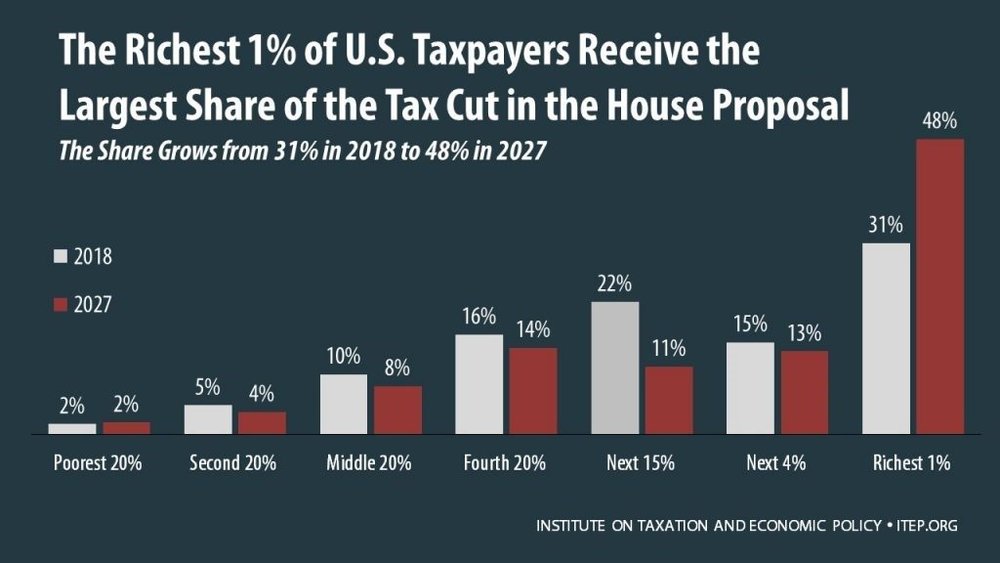

Americans Brace for the Republican Tax Bill

There are people who want to win against the system whenever the tax law changes, especially, when it’s meant to happen in a short time. Like, in no more than three weeks before the year ends. On Friday, a lot of people have had concerns and questions regarding prepaying taxes after the federal tax bill appeared. It is also a tactic that ranges wide among paying the taxes early as an effort to save some money.

Thought it might seem contrary to what everyone would expect, there are times when the taxes you pay for one year instead of another, makes you come out ahead when it comes to your finances. The number of your deductions will depend on your income and the changes being made in tax law.

The prepayment move, a lot of people hoped to make, have been cut by authors of the tax bill and left them with at least two options.

According to both, the staff members from committees, relevant house and the bill here are the breakdowns of the options for the people who have available money to prepay their personal taxes. This should help convince you and let you know about an early payment of taxes.

Taxes from Local and State Income

Local Taxes and State Income Cuts

Think about your State and Local Income Tax. Have you thought about the local income taxes, local property taxes, and the summation of both on your federal income tax return? You better think of them now since you won’t be able to have deductions of more than $10,000 starting the next year. This includes the sales and the property taxes of the states having no income tax. Then, prepaying some of your taxes in 2018 would be reasonably tempting if your total is more than the stated $10,000. This is one way that could help you a lot in saving money this year.

The authors of the Republican tax bill are undoubtedly smart, they’ve already read your mind. Their final bill prohibits taking a deduction in the current year if you opt to pay in advance the income tax for next year.

Taxes on Property

Be Sure to Pay your Property Tax Diligently

The authors of the final bill did not prohibit the prepayment of the local property taxes even when they had the opportunity to do so. This is the reason why you should seriously consider paying your property taxes this year to save money while the $10,000 cap has not yet been implemented.

There are different rules in jurisdictions, why it is better to check with your local taxing authority about the amount you can really pay in advance before you start lining up your tax payments.

Your Quarterly State Income Duties

Make Sure to Know the New Policy of Your Quarterly State Income Tax

Your next due will be on the 16th of January if you are not a regular employee and belong to the group of people doing freelancing jobs, thus, the quarterly income payments. Even though you still have 16 days until next year, the said payment will be set for the fourth quarter of the year. This means that, technically, it is not a prepayment if you pay for it now.

The prohibition on prepayment on the new bill for next year’s state income taxes won’t keep you from paying that quarterly state income on or before the 31st of December. The deduction of your tax payment for the 2017 tax return will be possible if you filed for payment before your due and if everything goes smoothly with your state duties.

More in Advisor

-

`

Will Bitcoin Crash to $0 or Hit $500K in a Decade?

Bitcoin’s future divides analysts into two extreme camps. Some see it becoming one of the most valuable financial assets in history....

October 12, 2025 -

`

Can Anyone Really Blame Mariah Carey for ‘Leaving’ the Real World?

Mariah Carey isn’t like the rest of us. From the moment she opens her mouth and that voice pours out, she...

October 10, 2025 -

`

Intel Invests in Nvidia, but Ratings Remain Unchanged

Intel’s stock jumped more than 30% after news broke that Nvidia poured $5 billion into the company. The rally sparked renewed...

October 5, 2025 -

`

Homeownership vs. Real Estate Investment: What’s Better?

Homeownership has long been seen as the American dream. But today, more people are asking: Is it really the smartest way...

October 3, 2025 -

`

Why the Armani Fashion Empire Is Set for an IPO

Giorgio Armani, one of the most iconic names in global fashion, left behind a detailed plan for the future of his...

September 27, 2025 -

`

Why Do Pokémon Cards Outperform the S&P 500 As an Investment?

Pokémon cards have outperformed the stock market by a mile. Since 2004, they have delivered a staggering 3,821% return, according to...

September 27, 2025 -

`

America’s Billionaires Get Older—Millennials Wait for Wealth Transfer

Many of today’s billionaires don’t match the youthful tech-founder image often portrayed. While names like Elon Musk, Sam Altman, and Mark...

September 21, 2025 -

`

Can President Trump Legally Fire Fed Governor Lisa Cook?

Lisa Cook is right in the middle of one of the most explosive legal battles in Washington. President Trump wants her...

September 20, 2025 -

`

Jeff Bezos’ Advice for Millennials Who Want Financial Success

Millennials today have grown up in a world where instant access to products and services is the norm. From two-day deliveries...

September 13, 2025

You must be logged in to post a comment Login