Is It Worth Taking Risk When It Comes to Investing For Retirement?

When you’re in your 20s, you have many things on your mind other than retirement. But that doesn’t make retirement planning any less important. You need a comfortable lifestyle after you quit the 9-5, right? So why not get on board with making your 60s the best years of your life ASAP? ‘Coz any of your fantasies aren’t going to matter if you’re not financially stable by then.

Unsplash | To really enjoy your retirement, you need to be financially stable when you enter your 60s

But we understand that managing round the clock work schedules, timely savings, and retirement planning at once can be challenging. And that’s why we’re here to help!

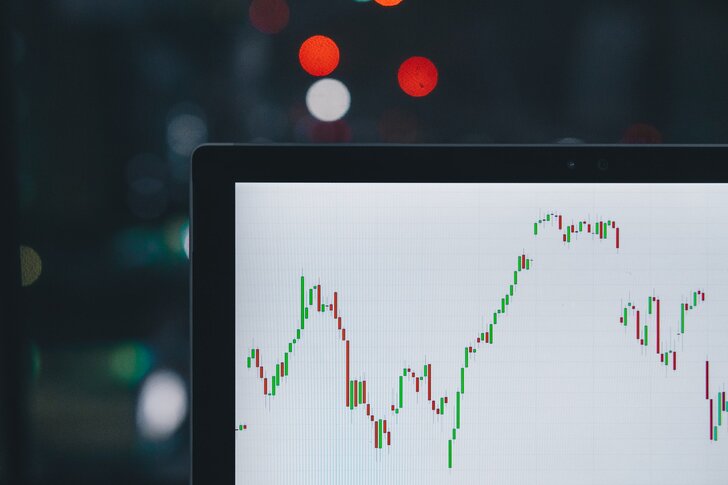

Investing in stocks is an option that you can take to accumulate wealth comfortably. But are you new to the field? Don’t worry. Today we’ll clear all your misconceptions around investments and hopefully help you make good money decisions.

Read – How to Become a Financial Expert on Your Own

Reward or risk

Before you get into an investment, you must know how conservative or aggressive your strategy should be. We know your savings matter to you, and your natural instincts will push you to be conservative. But trust us, this has proven to be a huge mistake for most. If you opt to invest conservatively, it’s pretty obvious that you’ll choose bonds and turn your back at stocks.

Unsplash | Most people prefer bonds over stocks because they’re less risky

There will be times when the stock market will be volatile, leading you to throw all your money anywhere but stocks. But before you do that, you must know that there’s a higher return rate in stock than in bonds.

Over the centuries, stocks have proven to yield an average return of 10 percent per year. On the other hand, with government bonds the returns are likely to be only 5 to 6 percent per year. You may not find any considerable difference between 10 percent and 5 percent return rate, but trust us, that difference will turn into almost 1.5 million dollars by the time you retire!

Market crashing

One of the primary reasons why investors don’t want any part in aggressive investment is because they fear that someday the market will crash and destroy their life savings. And we know we just told you that investing conservatively isn’t the best idea, it really depends on where you are in your life.

Unsplash | But if you keep avoiding stocks, you’ll never be able to accumulate millions for your retirement

If you’ve hit your 60s, you should be saving in a conservative strategy. There’s not much time for your money to recover from the market downturn. But now you’re nowhere near that mark. Hence the market crashing won’t be your worst nightmare. Your savings may take a hit in the short term, but you’ll get ample profit in the long run.

Read – What Are The Ways To Plan Medical Expenses In Retirement?

To sum it up

Although stocks are a risky bet when compared to bonds, they have a tremendous growth rate. By staying away from stocks you may think you’ll reduce the risk factor, but you should know that won’t get anywhere near an extra million dollars if you keep playing it safe!

More in Advisor

-

`

Celebrity Couples Who Have Ended Their Relationships in 2025

2025 has already seen its fair share of celebrity breakups, and the year is just getting started. From heartfelt announcements to...

February 6, 2025 -

`

How Trump’s Policies Will Reshape Artificial Intelligence in the U.S.

The United States witnessed a significant political shift as Donald Trump took the presidential oath once again. His return to the...

January 31, 2025 -

`

Millie Bobby Brown Shuts Down Age-Shamers with a Powerful Message

From the moment Millie Bobby Brown first appeared as Eleven in “Stranger Things,” she captured hearts worldwide. But growing up in...

January 25, 2025 -

`

Why Outsourcing Payroll Services Is a Smart Business Move

Managing payroll is no small task—it’s a crucial part of any business that ensures employees are paid accurately and on time....

January 15, 2025 -

`

These AI Stocks Should Be on the Watch List of Investors in 2025

The buzz around AI stocks is growing louder than ever. With artificial intelligence shaping industries like healthcare, finance, and tech, smart...

January 8, 2025 -

`

Why the Starbucks Workers Strike Is Expanding Across U.S. Cities

The Starbucks workers’ strike has gained significant momentum, with employees in more U.S. cities joining the movement to address unresolved issues...

January 2, 2025 -

`

Are Shawn Mendes and Camila Cabello Still Close After Breakup?

The connection between Shawn Mendes and Camila Cabello continues to intrigue fans worldwide. Their shared history, from chart-topping collaborations to a...

December 24, 2024 -

`

Here’s What It Takes to Become a Professional Physical Therapist

Physical therapy is a career that blends science, empathy, and problem-solving to help people recover from injuries or improve mobility. Knowing...

December 19, 2024 -

`

GM Battery Cell Plant Deal Marks $1 Billion Ownership Shift

General Motors (GM) plans to sell its stake in a $2.6 billion electric vehicle battery cell plant in Lansing, Michigan. This...

December 11, 2024

You must be logged in to post a comment Login