China’s ISP Giant Tencent To Invest In Vipshop

Tencent was founded in November 1998, leading Internet value-added providers in China that maintained a steady growth under the user-operating strategies since it was established. The Chinese Internet Giant Tencent went public on the main board of Hong Kong Stock Exchange on the 16th of October 2004, as the most valuable company in Asia with a capitalization in the market of $473 billion.

It now plans to invest over 4.2 billion yuan to get a 5% stake in the supermarket operator Yonghui Superstores Company Limited. It is already a major stakeholder in JD.com. On Monday, the Chinese giant, Tencent Holdings Limited said that they would lead an investment of $863 million in the apparel platform, Vipshop. Tencent Holdings and JD.com owns WeChat and will subscribe to the newly issued ordinary shares (Class A) of Vipshop.

The price of purchase will be $65.40 for every ordinary share (Class A).

Tencent to Invest in Online Giant Retailer Vipshop

This will have an equivalent $13.08 per American Depositary Share of Vipshop and a 55% premium over the ADS’ closing price on Dec. 15. Vipshop’s co-founder, chairman, and Chief Executive Officer, Eric Ya Shen, is delighted with the new strategic cooperation relationships with Tencent and JD.com. This is an important event for Vipshop as it is for the internet industries and e-commerce of China.

According to Shen, they will form a strategic alliance a win-win cooperation that would benefit the consumers and internet industries. They will also expand the said strategic alliance into broader areas.

Vipshop was founded in 2008 and has over 60 million active customers. It is also China’s largest online discount retailer when we talk about transaction value and works over 22, 00 brands. On the 30th of September, the New York Stock Exchange-listed Vipshop has net income of $50.8 million and $2.3 billion worth of net revenue.

This acquisition can compete against Mei.com owned by Alibaba. Mei.com is a similar flash sale site but smaller than Vipshop.

This Recent Acquisition Move Is Expected to Compete with Alibaba’s Mei

This will add a large number of female users to JD.com. The investment will help tap the young, female shoppers and give access to the consumers and data transaction to help compete against Alibaba’s Alipay. According to OC&C Strategy Consultants partner, Pascal Martin, the said investment makes ecosystem retail for the group and opens a lot of doors to provide different brands and channels from introducing new products.

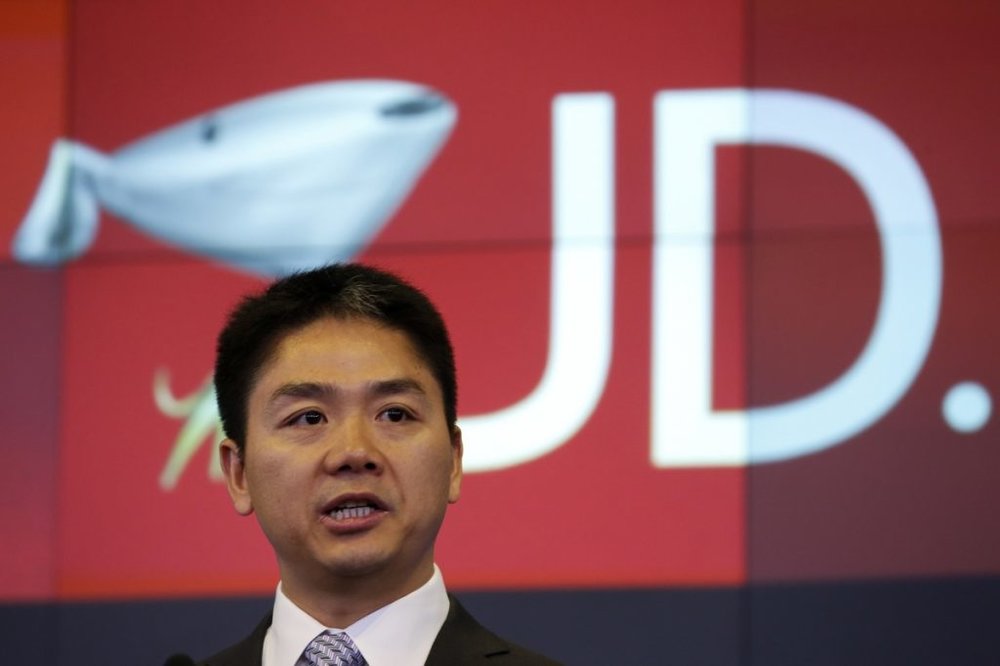

According to Richard Liu, JD.com’s CEO, this would help in expanding the business in the field of fashion.

This investment will up the rivalry with Alibaba Group Holding Ltd. Tencent will also invest as much as $604 million for a 7% stake in Vipshop. Their long-standing ally and e-commerce firm, JD.com Inc go for a 5.5% stake in investing $259 million. Tencent’s purchased stick was significantly higher than JD.Com. When the media had asked about it, neither companies have yet to release their comments and official statements since Monday.

Richard Liu Is Confident that the Looming Competition Will Boost the Country’s Fashion Industry

The said deal extends a push by Tencent into the home turf of Alibaba. The firm is hoping to have the leverage of the messaging service WeChat by its online system of payment by driving shopping demand. The tie-up would bring Vipshop Tencent’s payments support marketing solutions, and audiences to help in tapping the rising middle class of China according to Tencent’s President, Martin Lau.

Alibaba and Tencent have been competing in their investments from diverse areas as food delivery, bike-sharing, and even gaming. All these are the lists of the rivalry that reflects a long-running stand-off between the two companies.

According to Weiwen Han, the investments for the online retail shop and industry will drop in both companies, seeing as they are China’s two internet giants.

Weiwen Han Contemplates the Recent Giant’s Movements will Help Shape the Chinese Market to Become Globally Competitive

However, he added that such ventures are hard to succeed since it is still yet to be seen how they will be successfully integrated or whether they will turn into effective investments. Alibaba looks to reshape the battle lines of China’s market, both online and offline. The Tmall and Taobao platforms are dominating online and it invested $10 million in order to brick-and-mortar the stores.

More in Business

-

`

Will Bitcoin Crash to $0 or Hit $500K in a Decade?

Bitcoin’s future divides analysts into two extreme camps. Some see it becoming one of the most valuable financial assets in history....

October 12, 2025 -

`

Can Anyone Really Blame Mariah Carey for ‘Leaving’ the Real World?

Mariah Carey isn’t like the rest of us. From the moment she opens her mouth and that voice pours out, she...

October 10, 2025 -

`

Intel Invests in Nvidia, but Ratings Remain Unchanged

Intel’s stock jumped more than 30% after news broke that Nvidia poured $5 billion into the company. The rally sparked renewed...

October 5, 2025 -

`

Homeownership vs. Real Estate Investment: What’s Better?

Homeownership has long been seen as the American dream. But today, more people are asking: Is it really the smartest way...

October 3, 2025 -

`

Why the Armani Fashion Empire Is Set for an IPO

Giorgio Armani, one of the most iconic names in global fashion, left behind a detailed plan for the future of his...

September 27, 2025 -

`

Why Do Pokémon Cards Outperform the S&P 500 As an Investment?

Pokémon cards have outperformed the stock market by a mile. Since 2004, they have delivered a staggering 3,821% return, according to...

September 27, 2025 -

`

America’s Billionaires Get Older—Millennials Wait for Wealth Transfer

Many of today’s billionaires don’t match the youthful tech-founder image often portrayed. While names like Elon Musk, Sam Altman, and Mark...

September 21, 2025 -

`

Can President Trump Legally Fire Fed Governor Lisa Cook?

Lisa Cook is right in the middle of one of the most explosive legal battles in Washington. President Trump wants her...

September 20, 2025 -

`

Jeff Bezos’ Advice for Millennials Who Want Financial Success

Millennials today have grown up in a world where instant access to products and services is the norm. From two-day deliveries...

September 13, 2025

You must be logged in to post a comment Login