Doubtful Over Investment Strategies During The Pandemic? Here’s Some Help

The global pandemic has caused investors to worry about putting money in the stock market. People have started contemplating which stocks to trust and which not. In such a setting, even the tried-and-tested strategies of experts are being put to the test. As such, it’s only natural to wonder how you can maintain your investment portfolio.

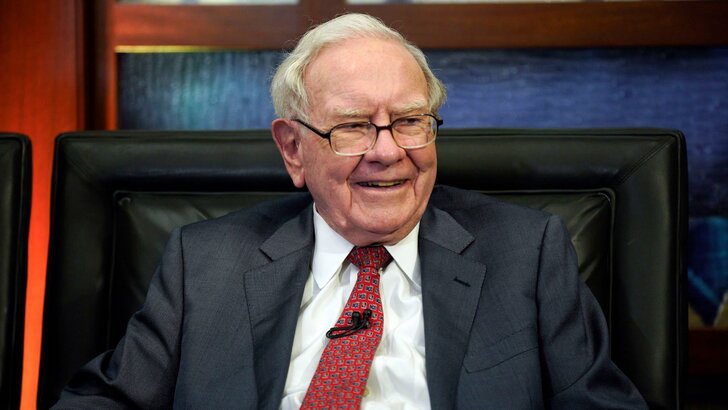

But what if we told you that we have help from the Oracle of Omaha himself? Yup, you guessed it right! We’ve rounded up some powerful tips from Warren Buffet to help you rise up to the challenge of the present stock markets. These words of wisdom have been coined by the $85 billion worth Buffet himself, so you better not miss them if you need to stabilize your funds.

Quartz | Even with financially volatile times like today, Warren Buffet says there’s nothing to be afraid of

Without further ado, let’s begin.

Read – Why are stock market prices rising despite the pandemic?

It’s not what you think

Recently, Warren Buffet was invited to several interviews where he was asked what investors should do in response to situations like the Coronavirus pandemic. The billionaire’s take was that it wasn’t a good idea to invest in stocks based on news headlines.

He revealed that the advice he’d shared with Berkshire Hathaway 30 years back holds relevant even today when the novel Coronavirus is causing concerns worldwide.

He said that such periodic spurts are likely to happen always. After all, you can’t foresee when an epidemic will occur! He said that instead of anticipating diseases no-one can predict, people should focus on the two super-infectious conditions each one of us deals with every single day – fear and greed.

TIME | Buffet says the only diseases investors should worry about are fear and greed

He said that from an investment point of view, periods like the current global scenario are ideal. He said that every diligent investor’s goal should be to be greedy when others are fearful and to be fearful when others are greedy.

Which path should you choose?

There are no second thoughts that today most investors are worried. The CBOE volatility index or fear index has been high for a couple of weeks. And when VIX rises, it’s a clear indication that most investors are scared.

Now, if you think the Oracle of Omaha was right in 1987 then, the time has come to become desirous. But what does that mean? It means that when investors are frightened in times like today, it’s quite opportunistic to buy the right stocks because right now you can get stocks of highly dependable and profitable companies at very low rates.

Getty Images | You should try buying stocks of dependable companies that are currently available at low prices

Read – Stock market investors start to look beyond Coronavirus

Summarizing Buffet’s golden words

Probably the best thing Warren Buffet has ever said is that no one has ever had, or will ever have, an idea of whether the market will rise, fall, or stay stagnant in the future. So, it’s not fair to “assume” a stock will rise or fall. Neither has Buffet ever known this, nor can you. All that we can know is the current value of the stocks. So buy them while they’re priced more impressively than a while before

More in Investments

-

`

The Push for Tax-Free Tips in America – A Win or a Risk?

Tipping has long been a fundamental part of the American service industry, providing essential income for millions of workers. However, the...

February 20, 2025 -

`

Matthew Perry Foundation Launches Addiction Fellowship at MGH

The impact of addiction on individuals and families is profound, and the need for specialized medical care in this field has...

February 13, 2025 -

`

Celebrity Couples Who Have Ended Their Relationships in 2025

2025 has already seen its fair share of celebrity breakups, and the year is just getting started. From heartfelt announcements to...

February 6, 2025 -

`

How Trump’s Policies Will Reshape Artificial Intelligence in the U.S.

The United States witnessed a significant political shift as Donald Trump took the presidential oath once again. His return to the...

January 31, 2025 -

`

Millie Bobby Brown Shuts Down Age-Shamers with a Powerful Message

From the moment Millie Bobby Brown first appeared as Eleven in “Stranger Things,” she captured hearts worldwide. But growing up in...

January 25, 2025 -

`

Why Outsourcing Payroll Services Is a Smart Business Move

Managing payroll is no small task—it’s a crucial part of any business that ensures employees are paid accurately and on time....

January 15, 2025 -

`

These AI Stocks Should Be on the Watch List of Investors in 2025

The buzz around AI stocks is growing louder than ever. With artificial intelligence shaping industries like healthcare, finance, and tech, smart...

January 8, 2025 -

`

Why the Starbucks Workers Strike Is Expanding Across U.S. Cities

The Starbucks workers’ strike has gained significant momentum, with employees in more U.S. cities joining the movement to address unresolved issues...

January 2, 2025 -

`

Are Shawn Mendes and Camila Cabello Still Close After Breakup?

The connection between Shawn Mendes and Camila Cabello continues to intrigue fans worldwide. Their shared history, from chart-topping collaborations to a...

December 24, 2024

You must be logged in to post a comment Login