Looking to be “Good” With Managing Money? Follow These 3 Tips

If one says he is good with money, it may imply a couple of things. It may refer to a decent amount of savings, being good with family ad household expenses, or earning a lot.

In either case, they are on the safe side of the aisle. On the other hand, if one has none of the above, the sense of insecurity and discomfort is obvious. Which part of the aisle are you in? Are you on the secure side or on the insecure one?

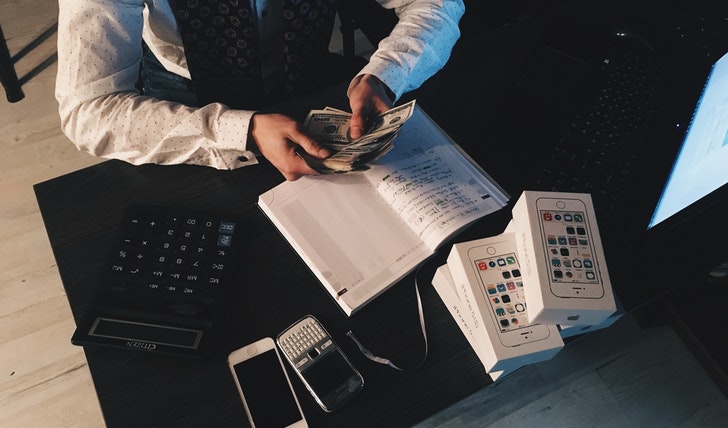

Pixabay / Pexels / It is never too late to be financially literate. You can be good with money at any part of your life – be it in your 60s.

Well, if your answer is the latter and you feel hopeless and disappointed, we have good news for you. There are some simple steps that you can take and take yourself out of the insecure aisle. Whether you are struggling with savings, household expenses, or you are drowned in debt, it is never too late to come out of it.

With that said, we have collected 3 simple and expert-backed tips that will make you “good” with money in no time. Let’s go through them step by step:

-

Consistently Check In With Your Money

One of the most influential ways to be good with your money is to check in to your account every now and then. More often than not, people feel embarrassed for checking in if they have less amount on the account.

You should have a pristinely clear idea about all the ins and outs of your money. Knowing every single cent, you should be in the position to know how is your money doing.

Kuncheek / Pexels / A weekly pondering over your expenses and income is crucial to be good with money.

In simple terms, you should have a proper track of your income, cash flow, and expenses. At least once a week, you must sit back and dedicate some time to your finances. “20 minutes is more than enough,” suggests top-class financial counselor, Kimbree Redburn.

She further asserts that “you must dedicate a specific time of the week in your calendar and follow that. Just like you deal with your other commitments, stick to this one as well.

-

Assign A Job to Every Single Cent You Earn

Another effective way to be good with money is to diversify your income portfolios. “Assign a job to every single cent you earn,” recommends Redburn. What she means is do not let your income – be it a monthly check or any other one – sit in your bank. Rather, let that money make more money for you.

Pixabay / Pexels / Those who understand money make it work for them. And those who don’t, work for it for their whole lives.

Nonetheless, it is crucial to be careful as you put your money into something – in order to make more money for yourself. For that, you will have to do your own proper research and choose an investment portfolio that best befits you and your objectives.

-

Think Twice Before Making A Purchase

It is obvious that the things that we purchase every day drain money from our wallets. But most of the time, purchases are unnecessary and need to stop – if you are looking to be good with money. Before making a purchase, ask yourself: Do I really need this right now? If the answer is no, wait for 24 hours and an answer will pop up by itself.

More in Advisor

-

`

Brad Pitt’s ‘Semi-Retirement’ Plans

Brad Pitt, known worldwide for his Academy Award-winning acting and top-notch production skills, is not just a Hollywood sensation; he’s a...

December 9, 2023 -

`

Streaming Giant Netflix Faces Yet Another Challenge

In the ever-evolving landscape of streaming entertainment, Netflix, once the unchallenged king of digital content, now faces a complex puzzle beyond...

December 1, 2023 -

`

Signs You Should Quit Your Current Job & Move On

You Don’t Feel Comfortable at Work Imagine spending the majority of your waking hours in a place where you feel uneasy,...

November 20, 2023 -

`

How to Adjust and Renew Your Portfolio

Investing in the financial world is like navigating an ever-changing landscape—constantly evolving, always shifting. The key to staying on track? Regularly...

November 18, 2023 -

`

Dr. Dre’s Divorce With Nicole Young: A Closer Look

When the beats of old-school hip-hop start bumping, Dr. Dre’s name reverberates in fans’ minds worldwide. Born as Andre Young, this...

November 12, 2023 -

`

Why Branded Content Is the Best Way to Connect With Your Audience

Have you ever found yourself deep in a compelling article or engrossed in a video series, only to later discover that...

November 5, 2023 -

`

Why the Gender Pay Gap Could Be Getting Worse | New Research Findings

At a time when women are making significant strides in various professional arenas, a new report throws light on a trend...

October 28, 2023 -

`

What Is a Bull Market and How Can Investors Benefit From One?

In finance, the term “bull market” is frequently used to describe a period of optimism, rising asset prices, and investor confidence....

October 19, 2023 -

`

A-List Power Couples Where the Women Make More Money

In an era of shifting gender roles and evolving definitions of success, it’s increasingly common to find celebrity couples where the...

October 15, 2023

You must be logged in to post a comment Login